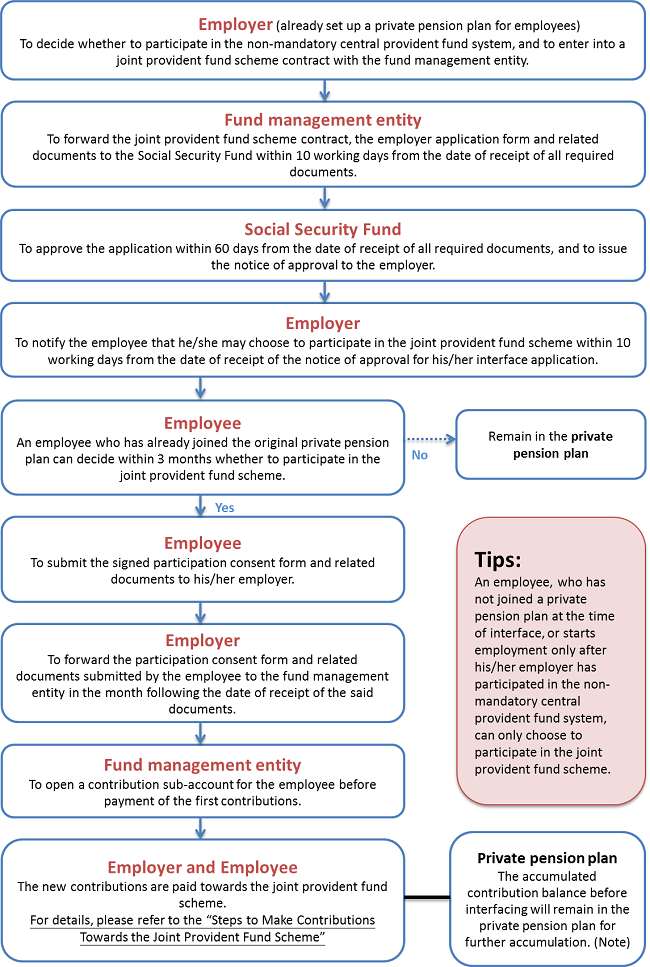

(Note) The account owner may apply to the Social Security Fund, within 3 months from the date of obtaining the benefits from the private pension plan, for transferring the related benefits to his/her individual account.

• In terms of employees:Old system for old employees New system for new employees

The term“old employees" refers to the serving employees who have already joined the private pension plan of the company before the employer participates in the non-mandatory central provident fund system. They can choose whether to interface the private pension plan with the non-mandatory central provident fund system and keep some of the terms of the private pension plan;

The term "new employees" refers to the employees who do not join the private pension plan of the company, or they are the new hires of the company. They can only choose to participate in the non-mandatory central provident fund system and comply with its provisions.

Note 1:

These are the basic standards. Employers can set more favourable terms for their employees.

Note 2:

When the employee’s contribution time fulfils the requirement for obtaining all of the employer’s contribution benefits, the employee will be entitled to determine the funds to be invested and the allocation ratio for the employer’s contributions.

Note 3:

The upper and lower limits for the calculation base of contributions are linked to the “Minimum Wage for Employees”. The current minimum wage stands at 7,280 patacas per month. If this amount is adjusted, the amounts for the upper and lower limits for the calculation base of contributions will also be automatically adjusted.

Note 4:

If an employer does not rescind the labour contract on reasonable grounds, or the employee rescinds the labour contract on reasonable grounds, the employee will be entitled to the dismissal compensation. For details, please see Articles 70 and 71 of Law No. 7/2008 (Labour Relations Law).