The Social Security Fund (abbreviated to FSS in Macao) of the Macao SAR Government is a public legal person with administrative, financial and property autonomy. Subordinate to the Secretariat for Social Affairs and Culture, the FSS is responsible for implementing various policies and measures in the field of social security and managing related resources.

Established on 23 March 1990, the FSS at that time mainly provided social security for local employees. Through the implementation of Social Security System of Decree No. 84/89/M, financial subsidies for old age, unemployment, and illness were provided to local employees. With the development of society, the FSS continuously strived to expand social security coverage and carry out various service reforms, e.g. the FSS started to introduce voluntary contributions (people who had stopped working for others could continue to make contributions) and contributions for the self-employed workers since 1993, and some new benefits were added. In order to focus the functions and resources of FSS on old-age security, the granting of relief funds was transferred to Social Welfare Bureau in 2007; and the pension age was lowered in 2008 in response to social demands.

Guaranteeing residents’ lives is the basis for social harmony and development, and building a relatively complete old-age security system is an important cornerstone. As the aging of society intensified, residents were increasingly in need of universal coverage. Thus, in November 2008, the SAR Government announced the “Social Security and Old-Age Pension System Reform Programme” — its core content was to build a two-tier social security system. That is to say, all Macao residents can obtain basic social security, especially old-age security, through the first tier (Social Security System), in order to improve the quality of life of residents, whereas the more comfortable life after retirement is supported by the second tier (Non-Mandatory Central Provident Fund System).

Law No. 4/2010 (Social Security System) officially came into effect on 1 January 2011, and Law No. 7/2017 (Non-Mandatory Central Provident Fund System) was implemented on 1 January 2018. By this time, Macao’s two-tier social security system has entered a new milestone. In order to effectively implement the new functions, the new By-Law (Organization and Operations of the Social Security Fund) also came into effect on 18 July 2017.

Improvement of the two-tier social security system and continuous enhancement of service quality are the focus of FSS, which is committed to maintaining the basic level of old-age security for residents and the sustainable development of social security system. At the same time, the FSS actively promotes the participation of employers, employees and individuals in the Non-Mandatory Central Provident Fund System, in order to strengthen the protection of residents’ life after retirement, and strives to provide residents with better and more convenient social security public services through the electronization of services.

In the 1980s, Macao’s continued economic take-off aroused the aspirations of society to provide protection for local workers and establish a social security system. After extensively listening to opinions from all walks of life, Decree-Law No. 84/89/M was promulgated on 18 December 1989 to formulate a social security system, and Social Security Fund (abbreviated to FSS in Macao) was established to implement the system.

On 23 March, the FSS was officially put into operation. Subordinate to the Secretariat for Health and Social Affairs at that time, the FSS was a public legal person with administrative, financial and property autonomy. The Administrative Committee was established as the management organ of the FSS, and its members included representatives of the government, employer and employee parties. The purpose of establishing the FSS was to implement the Social Security System, which allows the Macao residents receive protection for their living when they are unable to work due to old age, disability, unemployment and illness.

The initial protection targets were mainly local long-term employees working for others, and the benefits included old-age pension, unemployment benefit, incapacity payment, sickness allowance and compensation for Pneumoconiosis, etc.

Decree-Law No. 58/93/M was passed on 18 October 1993 to include temporary workers in the scope of social security, introduce voluntary contributions to broaden the scope of contributions, improve existing benefits, which includes adding new benefits (birth allowance, marriage allowance, funeral allowance, etc.) and an additional payment, formulate a minimum 60-month contribution requirement for old-age pension, and introduce a penalty system for employers who fail to fulfil their contribution obligations, etc. in order to gradually improve the Social Security System.

Later, in order to ensure that self-employed persons are protected as well, especially old-age security, the FSS adopted a gradual approach between the years from 2001 to 2007 - self-employed workers in 30 different industries, such as insurance practitioners, tour guides, doctors, therapists, masseurs, acupuncturists, and taxi drivers were included in the Social Security System.

After returning to the motherland in 1999, the FSS came under the jurisdiction of the Secretariat for Economy and Finance.

In 2007, in order to cooperate with Social Welfare Bureau's granting of financial aid to individuals or households in a state of economic poverty, the aid payment cases previously handled by the FSS were transferred to the Social Welfare Bureau after the introduction of By-Law No. 6/2007, making the two concepts of “social security” and “social relief” more clearly defined.

The Labour Relations Law, which came into effect on 1 January 2009, included domestic workers in its applicable scope. Employers are obliged to pay contributions for their local and non-resident domestic workers, and local domestic workers are also included in the Social Security System so that they can enjoy the same benefits like ordinary local employees.

The “Law on Employment of Non-Resident Workers” that came into effect on 26 April 2010 requires employers to pay an employment fee for each non-resident worker actually hired.

In addition, starting 2008, in order to satisfy the aspiration of residents to lower the age to apply for old-age pension, the SAR Government allowed beneficiaries attaining the age of 60 and under the age of 65 to receive old-age pension on percentage.

In order to provide protection for the living of Macao residents in their retirement, the SAR Government proposed in 2008 the idea of a two-tier social security system, including the first-tier (Social Security System) and the second-tier (Central Provident Fund System).

In 2011, the FSS was transferred to the jurisdiction of Secretariat for Social Affairs and Culture, and at the same time, Law No. 4/2010 (Social Security System) officially came into effect, reforming the contribution system by rolling out the obligatory and arbitrary contribution systems, in order to expand the scope of protection to the entire population. With regard to the second-tier (Central Provident Fund System), the SAR Government first regulated the government appropriation in 2009 through By-Law No. 31/2009 (General Rules for the Opening and Management of Individual Accounts under the Central Savings System). Then in 2010, government funding was injected into the individual account of each eligible participant for the first time. Taken into effect on 15 October 2012, the Law “Provident Fund Individual Account” replaced the “Central Savings System”, laying the foundation for the establishment of Non-Mandatory Central Provident Fund System that includes contributions of employers and employees, thus gradually advancing to the realization of a two-tier social security system.

Afterwards, the FSS prepared the first draft of the proposed plan for the “Non-Mandatory Central Provident Fund System” and conducted extensive consultation in 2014. After summarizing opinions from all walks of life, the draft law was submitted to the Legislative Assembly, which was passed in detail on 31 May 2017. Law No. 7/2017 (Non-Mandatory Central Provident Fund System) came into effect on 1 January 2018 and Macao’s two-tier social security system has entered a new stage since then.

With the implementation of the “Non-Mandatory Central Provident Fund System”, it indicates that the core function of the FSS has expanded from the implementation of one single system (Social Security System) to the simultaneous implementation of two systems (Social Security System and Central Provident Fund System).

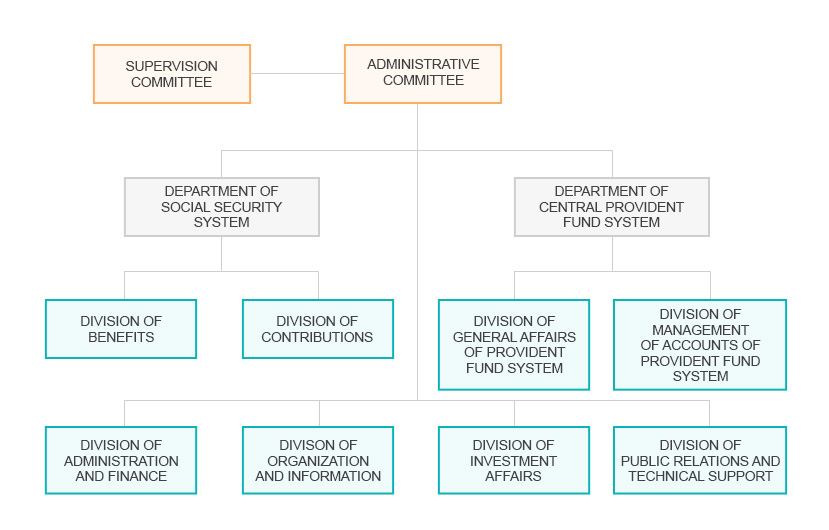

Effective on 18 July 2017, the "Organization and Operation of the Social Security Fund" added a vice-president, a department and four divisions (including the Department of Central Provident Fund System, Division of General Affairs of Provident Fund System, Division of Management of Accounts of Provident Fund System, Division of Investment Affairs and Division of Public Relations and Technical Support), to effectively implement the governance goals and perform new functions.

In January 2018, the “Employment Incentive Programme for Disability Pension Beneficiaries” was officially rolled out to provide beneficiaries who want to get a job again with trial work opportunities, enhancing their motivation and confidence to re-enter the labour market and helping them integrate into society. In October of the same year, the SAR government revised the relevant laws to make the disability pension universally applicable to all people with disabilities.

In order to ensure the sustainable operation of the Social Security System, Law No. 14/2019 (Consolidation of the Financial Resources of the Social Security Fund) took effect on 13 August 2019 to increase the financial sources of the FSS. The Law also stipulates that 3% of the balance of the central budget implementation of the Macao SAR after the end of each fiscal year shall be allocated to the Social Security Fund.

In 2020, the FSS marked its 30th anniversary. After years of improvement, its service network has expanded from a single service point at St. Lazarus Parish Field Office to offices or service areas at NAPE, Areia Preta and Islands District. Residents can also check and handle most of social security services by various electronic means.

Social Security Fund will continue to improve the two-tier social security system, and in particular to promote the transition of the second-tier (Central Provident Fund System) to mandatory implementation so that residents can receive better old-age security and actively promote e-government to provide the residents with more convenient and efficient social security services.