Income calculation period: January 1 through December 31

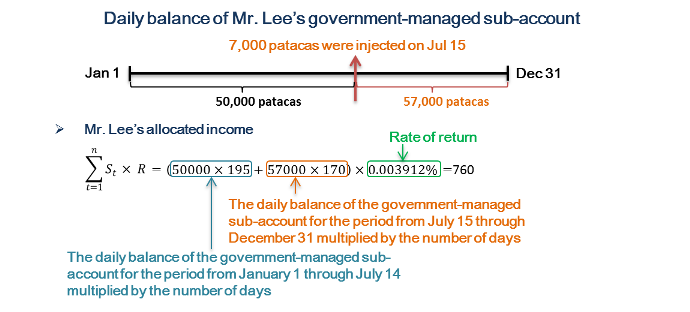

Example 1:

Mr. Lee, an account owner, has never applied to withdraw the balance or transfer the funds to other sub-accounts(assuming the rate of return is 0.003912%)

The government-managed sub-account balance of Mr. Lee as at January 1 is 50,000 patacas, and 7,000 patacas were injected on July 15. Therefore, the income for Mr. Lee’s government-managed sub-account for the income calculation period (January through December) is calculated as follows:

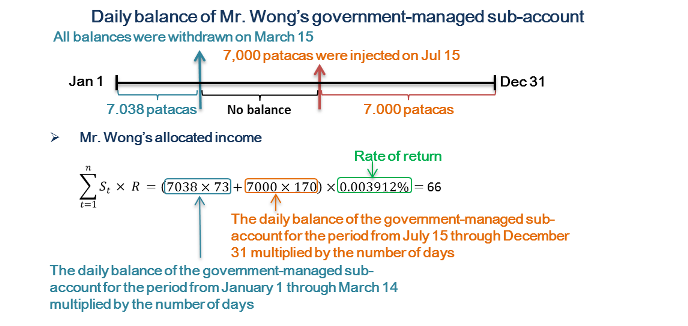

Example 2:

Mr. Wong, an account owner, has withdrawn the balance or transferred the balance to other sub-accounts (assuming the rate of return is 0.003912%)

The government-managed sub-account balance of Mr. Wong as at January 1 is 7,038 patacas. On 15 March of the same year, all balances were withdrawn or transferred to other sub-accounts, and 7,000 patacas were injected on July 15. Therefore, the income for Mr. Wong’s government-managed sub-account for the income calculation period (January through December) is calculated as follows: