Under the Non-Mandatory Central Provident Fund System, the upper and lower limits for the calculation base of joint provident fund scheme’s contributions, as well as the upper limit for the individual provident fund scheme’s contributions, will be automatically adjusted in accordance with the law subject to the increase in minimum wage to 7,072 patacas, starting 1 January 2024.

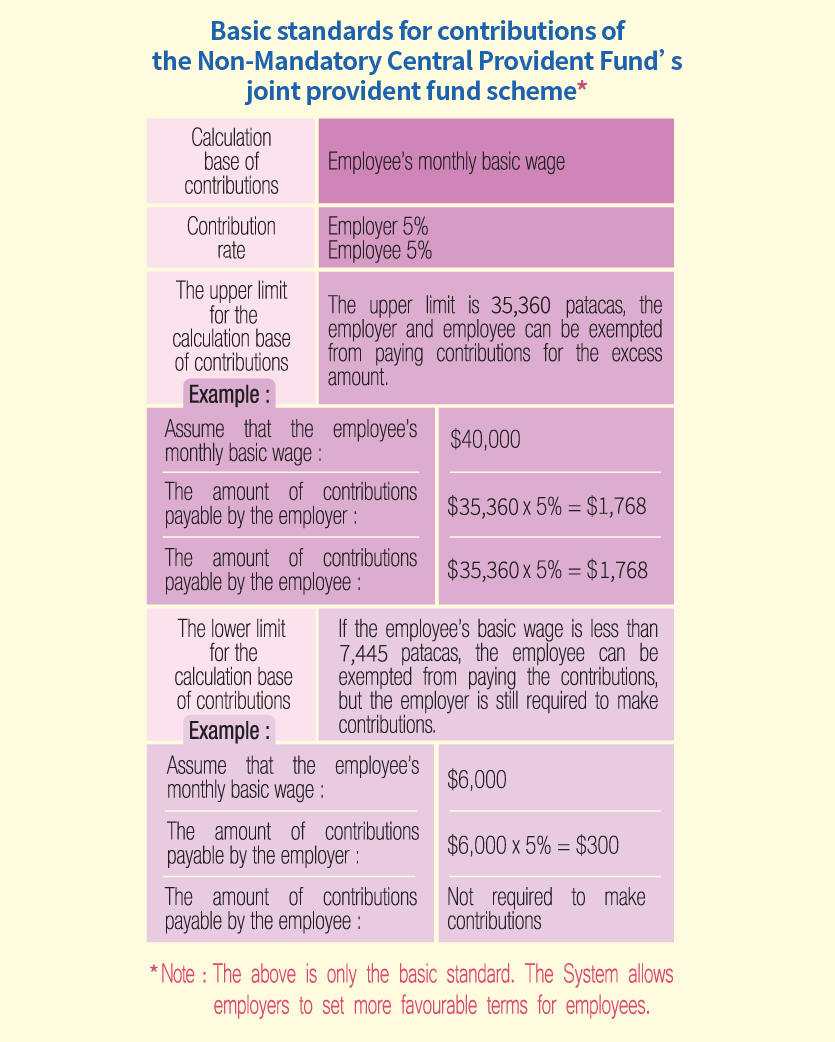

According to Law No. 7/2017 (Non-Mandatory Central Provident Fund System), the joint provident fund scheme uses the employee's monthly basic wage as the calculation base of contributions, and the amount of contributions is 5% of the calculation base of contributions. If the employee's basic wage after deducting the contributions is lower than the minimum wage, the employee is exempted from paying contributions but the employer is still required to make contributions; if the employee's basic wage exceeds the minimum wage by five times, neither the employer nor the employee is required to make contributions for the excess amount. After the minimum wage is raised, the lower limit for the calculation base of joint provident fund scheme’s contributions is raised to 7,445 patacas, and the upper limit to 35,360 patacas.

According to the same law, the maximum monthly contributions for the individual provident fund scheme is 10% of five times the minimum wage (rounded down to an integral multiple of one hundred patacas), so it is automatically increased to 3,500 patacas. In addition, the minimum contribution amount remains unchanged at 500 patacas.

If you have any enquiries, please call 2853 2850 during office hours, or visit the FSS’s website at www.fss.gov.mo.