The contribution schemes of provident fund are composed of:

1. Joint provident fund scheme: The scheme is set up voluntarily by the employer and joined voluntarily by the employee (Note 1, 2). Please click here for the “Steps to Set Up and Participate in the Joint Provident Fund Scheme”

2. Individual provident fund scheme: The scheme is set up and participated voluntarily by the individual account owner of the non-mandatory central provident fund system. Please click here for the “Steps to Set Up an Individual Provident Fund Scheme”

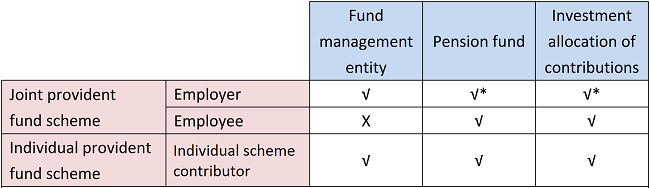

In respect to the right to choose the fund management entity (Note 3) and pension fund within the contribution schemes of the provident fund, different contribution schemes have different provisions on the right to choose.

Joint provident fund scheme

The fund management entity is chosen by the employer (Note 4). The employer and employee choose a suitable pension fund and investment allocation for their respective contributions, but the investment allocation percentage shall be at least 5% or an integral multiple thereof.

Individual provident fund scheme

The individual scheme contributors have complete discretion.

* When the employee’s contribution time fulfils the requirement for obtaining all the contribution benefits of the employer, the employee will be entitled to determine the funds to be invested and the allocation ratio for the employer’s contributions. The employer, from the date of setting up the joint provident fund scheme, may also transfer the investment right of his/her contributions to the related employee.

(Note)

(1) For the purposes of Law No. 7/2008 (Labour Relations Law), an “employer” means any natural or legal person, or association without legal personality, or special committee that, on the basis of a contract, has the power to exercise authority and direction over the employee and pays the latter remuneration for the work performed;

(2) Staff members of public sector cannot participate in the joint provident fund scheme, but they can still participate in the individual provident fund scheme;

(3) The “fund management entity” is an entity which has already obtained the permission given under Article 5(1) of Decree-Law No. 6/99/M of 8th February and is also permitted under the provisions of this Law, to register one or more of its managed pension funds under the non-mandatory central provident fund system;

(4) The employer may apply to switch the fund management entity thereafter, but subject to the approval of the Social Security Fund and shall not reduce the employee’s benefits granted by the original fund management entity, in particular, about the employer’s contribution rate, the calculation base of contributions and the vesting of benefits, and cannot affect the continuous calculation of contribution time.