• Individual account owners of the non-mandatory central provident fund system

The following Macao SAR residents can become individual account owners of the non-mandatory central provident fund system:

1. A person who has attained 18 years of age;

2. A person who is under 18 years of age, but has already enrolled in the social security system in accordance with Article 10(1)(a) of Law No. 4/2010.

• Individual accounts of the non-mandatory central provident fund system

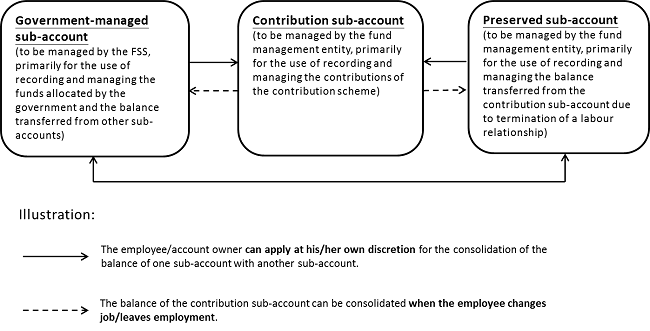

An individual account of the non-mandatory central provident fund system is composed of a government-managed sub-account, a contribution sub-account and a preserved sub-account:

- The government-managed sub-account is automatically opened for each individual account owner of the non-mandatory central provident fund system, by the Social Security Fund in accordance with its functions and powers;

- The contribution sub-account and preserved sub-account are opened by the fund management entity.

Rules for the transfer of funds:

1. All balances within the sub-account must be transferred;

2. The government-managed sub-account can be transferred in and transferred out once per year, subject to the approval of the Social Security Fund;

3. There is no limit on the number of times of the transfer of funds of the contribution sub-account and preserved sub-account, the account owner can do so by notifying the fund management entity;

4. The funds in the contribution sub-account can only be transferred to the preserved sub-account and government-managed sub-account at the time when a labour relationship terminates or an account owner stops making contributions towards the individual provident fund scheme.

• Characteristics of the individual accounts of non-mandatory central provident fund system

(1) The individual account of non-mandatory central provident fund system has a portability feature, i.e. the contribution sub-account will not be settled because of termination of a labour relationship. Under normal circumstances, an individual account owner of the non-mandatory central provident fund system must be at least 65 years of age to withdraw funds from the account;

(2) The individual account owners of the non-mandatory central provident fund system can apply for the transfer of funds between sub-accounts;

(3) The balances in the individual accounts of non-mandatory central provident fund system cannot be seized nor transferred.